Accounting

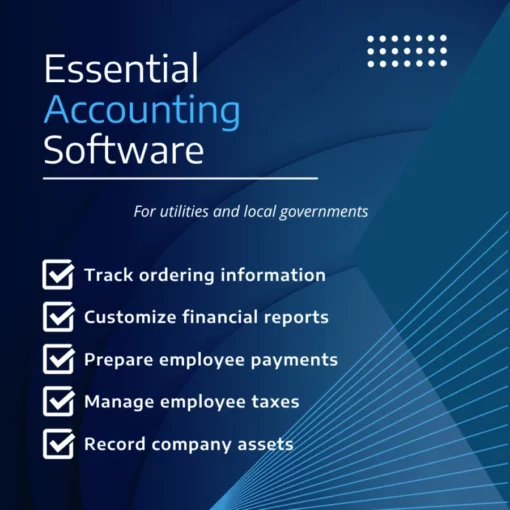

integrated modules and customizable setup to help optimize utility accounting processes and deliver a streamlined and efficient financial management solution.

Comprehensive financial management software for utilities

FULL-FEATURED APPLICATIONS FOR EFFECTIVE FISCAL ACCOUNTABILITY

Accounting can be tedious. Our Alliance™ Accounting suite of financial products will help make the process easier with programs that outline your financial position, promote sound decision-making, manage cash, and offer complete vendor analysis.

By following the basic principles of Government Accounting, Auditing, and Financial Reporting (GAAFR), these utility accounting solutions are designed to improve utility and governmental accounting, enhance financial reporting, and expand financial understanding and communication within your organization.

ALLIANCE™ ACCOUNTING APPLICATIONS INCLUDE

General Ledger

Comprehensively reflect your financial state with Alliance General Ledger. Tailor your GL to your accounting needs and record transactions independent of other apps.

Accounts Payable

Use Alliance Accounts Payable for complete control over payables, from invoice entry to payment approval and check printing.

Asset Management

Track vital assets with Alliance Asset Management. Record purchase dates and locations, disposal information, maintenance data, and more.

Payroll

Store employee data and manage payments with Alliance Payroll. Print checks, track benefits, manage tax information, and generate W-2s for your staff.

Accounting for utilities & local governments

Dynamic, adaptable financial applications

Whether it’s everyday financial management, processing accounts payable, reconciling billing accounts, or preparing for audits, our utility accounting solutions will help expand your capabilities with features designed for utilities and local government. Our dynamic recordkeeping and reporting tools address the complex operational and compliance requirements of utilities of all sizes and structures. Experience a user-friendly interface with customizable reports tailored to your organization’s needs, ensuring efficient and accurate financial management.

General Ledger

Adaptive and highly customizable basis for Alliance™ applications

With Alliance General Ledger, bring together all of your applications for a complete picture of your organization’s financial state!

Checks for Accuracy

- Pre-posting audits

- Automatic error-checking features to ensure transactions are accurate upon entry

Flexible Design

- Accommodates fund accounting, enterprise, and divisional or departmental accounting

- Accrual, modified accrual, or cash basis accounting

- User-defined account numbering format

- Reporting by fund or department

- Customizable financial statements

- User-tracked fiscal year accounting periods with user-defined begin/end dates

- Continuous processing and data entry while previous fiscal year is still open

Efficient Processing

- Easy-to-use journal entries process with automatic balancing

- Fast “smart” searches for accounts using virtually every data field plus searches using multiple data elements

- Processing codes for standard, recurring journal entries to speed up the transaction process

- Setup for recurring GL entries in fixed or variable amounts

- Provides for budget preparation with routines for easy budget adjustments

Extensive Data Tracking

- Detailed audit trail by transaction date, source, amount, and operator code

- Maintain previous fiscal year activity and store comparatives for multiple prior years

- Transaction entry for previous periods within the current fiscal year

- Maintain detailed ledgers listing all account transactions within a user-defined date range

FOLLOWS GAAP AND GAAFR STANDARDS

Accounts Payable

Centralized payment processing with vendor management

Monitor and manage purchases and payments with ease with Alliance Accounts Payable!

Flexible Check and Payment Processing

- Process invoices, credit, and debit memos

- Retain thorough information on each AP transaction

- Complete check writing with separate remittance advice routines

- Hold payment routines to prevent payment to questionable vendors

- Flexible remittance processing supporting typed, immediate-print, and manual checks

Comprehensive Vendor Profiles

- Complete vendor profiles outlining status, terms, YTD activity, and discount plans

- Miscellaneous vendor templates to handle one-time vendors and prevent accumulation of unnecessary data

- 1099s for simplified year-end processing

Quick Information Access

- Quickly access AP transactions and vendors

- Retain thorough information on each AP transaction

- Extensive audit trails and reports

Process Automation

- Time-saving automation features

- Allocation of expenses to different areas or departments handled easily with automatic distributions

Customizable System

- Set up custom accounts payable processing parameters

- Write from multiple checking accounts and banks

INTEGRATED PURCHASE ORDER ADD-ON AVAILABLE

Asset Management

Track asset activity from acquisition to retirement

With Alliance Asset Management, track values and locations via a complete asset tracking system.

Record Assets

- Maintain asset information like asset number, description, serial number, acquisition date, cost, salvage value, new or used classification, group, department, depreciation method, start date, service life, and status

- Automatically generate control numbers for tracking assets or enter user-defined numbers

- Track assets by user-defined groupings and departments

- Retain historical information for each asset and generate listings for taking periodic inventory of assets

Calculate Depreciations

- Automatically or manually calculate asset depreciation

- Eight available depreciation methods:

- Straight Line

- Fixed Percentage

- Fixed Percentage with Straight Line Crossover

- Declining Balance

- Declining Balance with Straight Line Crossover

- Sum of Years Digits

- Units of Production

- MACRS (Modified Accelerated Cost Recovery System)

- Calculate asset depreciation on a user-defined criteria, e.g. monthly, quarterly, annually

- Maintain detailed records of GL distributions resulting from asset depreciations

Track Activity

- Track asset activity from initial asset acquisition to retirement

- View a complete audit trail of all transactions with change logs and transaction posting registers

- Track disposal information (e.g., reason, approved by, date, and destination)

- Retain purchase information, including vendor, invoice number, PO number, approver, etc.

Payroll

Comprehensive personnel information maintenance system

Meet the demanding requirements of payroll processing with ease using Alliance Payroll!

Employee Tracking

- Complete employee profiles with helpful employment statistics and categorization options

- Quick access to current and historical employee data

- Categorize employees by positions, departments, job grades, management groups, and occupational classification

- Time entry process with defaults for quick processing

Flexible Setup

- Single- or multi-company payroll processing

- Salaried or hourly payroll, weekly, bi-weekly, semi-monthly, quarterly, and annual payment processing

- Wage date, department, position, and shift time entry options

- User-definable wage rates, pre-tax and after-tax deductions, and benefits

Payment Processing

- ACH direct deposits for payroll earnings

- Process regular, special, and typed checks

- Easy one-time deductions during standard time entry

- Calculate and print payroll earnings, taxes, deductions, and benefits

- Standard or average rate overtime computation

- Show current, monthly, quarterly, and yearly earning, tax, deduction, and benefit totals on employee check stubs

Tax and Year-End Processes

- Eases quarter-end and year-end activities with tax reports and W-2s

- Allows multiple “open” payroll years, making year-end activities more flexible

Extensive Information

- Extensive audit trails and reports

- Example check routine for calculating hypothetical payroll scenarios

- Total current, monthly, quarterly, and yearly earnings, taxes, deductions, and benefits

- Track employee accruals by days or hours for vacation, holiday, sick days, and workers’ compensation

More Efficient. More Effective. Greater ROI.

When you have the right tools for the job, everybody wins — especially your customers. Reduce or eliminate pain points, dramatically increase operating efficiency, and provide greater service. Fill out our contact form or call 800.455.3293 to learn more about how United Systems can help!